Forbidding To Pay Tax?

Luke 23: 1Then the entire assembly of them set out and brought Him before Pilate. 2 And they began to bring charges against Him, saying, “We found this man misleading our nation and forbidding us to pay taxes to Caesar, and saying that He Himself is Christ, a King.”

Why would someone get accused of “forbidding” to pay tax to a current government? This passage shows a couple of things: One, that the Pharisees did partially understand the genius of Jesus’s answer to their question, “Is it lawful to pay the temple-tax to Caesar”, when He said, “Render to Caesar what is Caesar’s and to God what is God’s.”; and, Two, that they were twisting this to their own purpose in hopes of using the power of the Roman government to discredit or eliminate Jesus. To render to God what is God’s can’t help but mean that Caesar is not going to be the recipient of that same tribute that went towards the Creator, which tribute – Caesar would very much like to have for his own purposes. “Caesar” in this case, I take for the entire host of men comprising the actions of civil government, including those who benefit from distribution of that “tribute”.

Here will attempt to consider universal, timeless principles, as well as how this applies to the contemporary American, at least, in 2022. Is it compatible with our standing in Jesus Christ to pay personal income taxes to this Federal, State, and County civil government? I will try to expand on several points to sharpen our perspective.

1. Who owns? “...whom He appointed heir of all things, through whom also He made the Ages…” (Hebrews 1) To a large degree, taxes are a ‘rent’ that is paid for the use of what belongs to another. This is more clear when we think of land and buildings, but it also applies to our Labor. If we belong to God, and He is the ultimate source of our mental and ‘muscle’ productivity, it is proper to render to Him whatever token tribute He would ask of us to honor that power that He gives us. Conversely, if our government doesn’t own our persons, our labor, and the fruits of that labor - we are not obligated to pay rent on that productivity. Yet we are obligated to pay “tax to whom tax is due” to those who are obedient servants of God, commuting His wrath on evildoers as He defines them. (Romans 13).

“Income” or “increase” is God’s gracious enabling because we are fulfilling God’s commands to be fruitful, multiply, fill the earth, cultivate it, and keep/guard it. By our labor we take things God created and manufacture them into what is more useful and more valuable to ourselves and others. God is the one who enables this increase, and this is partly the reason for us to return to Him a tenth of our increase as tribute and thanksgiving for enabling all this. When this honor is attributed to sinful human governors, and more than a tenth of this increase is paid to such civil governments, this becomes one of the aspects of idolatry.

Dt. 8:17 Otherwise, you may say in your heart, ‘My power and the strength of my hand made me this wealth.’ 18 But you are to remember the Lord your God, for it is He who is giving you power to make wealth, in order to confirm His covenant which He swore to your fathers, as it is this day.

We can consider it in either of two ways. Either our ‘increase’ doesn’t happen until we trade, where our ability to labor, or the labor itself is worth nothing, and after the trade for money or something else we consider more valuable than our labor – then we have an increase or profit – or God is the one who has given us the ‘value’ of our labor, and in our trade, there is equal value between our labor and the thing we are trading for – in which case there is no ‘income’, ‘profit’, or ‘increase’ at that point. Either way, this all belongs to God, and should the citizens and leaders of a political jurisdiction idolatrously claim it for themselves, then we have God’s solemn warning that many bad things are going to start happening.

Dt. 8:19 And it shall come about, if you ever forget the Lord your God and follow other gods and serve and worship them, I testify against you today that you will certainly perish.

2. Stewardship As our Owner, Jesus Christ, has granted us stewardship of our bodies and the “Stuff” we hold as separate from others in this world. We are responsible to acquire and dispense “wealth” as His revelation in the Bible directs us to. To this end we will promote “good”, and refrain from promoting evil. The steward is not faithful with the property he is in charge of if he offers it to support the Lord’s(owner’s) enemies. One of the functions of God’s definitions of crime and punishment given in the early part of the Bible is to guide us as to who is to steward what property in a given time and place. The workman is worthy of his wage. Should I not be able to do what I wish with what I own?

2 Chron. 19:2 And Jehu the son of Hanani the seer went out to meet him and said to King Jehoshaphat, “Should you help the wicked and love those who hate the Lord, and by doing so bring wrath on yourself from the Lord?

3. Penalties for Failure to Pay Minimum Tax Here is a watershed for interpretation. Most faithful Bible teachers with a sympathy for Austrian Economics see a call for drastic reduction from our current levels of taxation in the Romans 13 passage. If civil government only punished the crimes listed in the Bible (murder, theft, assault, breach of contract), it would be doing so much less, that the shared cost across society would be very minimal. This is especially true when you reflect on the “cities of refuge” arrangement, where the burden of proof was on an innocent, suspected criminal to bring his evidence to the judges first, when accident or circumstance would make it look like he was guilty of a crime. If he failed to do this when other accusers stepped forth, his avoidance of law enforcement would be encouragement for others to consider him guilty. This would cut way down on the cost of detective work and apprehending possible criminals (not to mention lessening the accidental punishment of the innocent).

Should we assume that the essential function of government consists only in punishing crimes listed in Scripture, consistency requires us to go one step further. If we are only going to punish what God gives authorization to punish, we must determine two things: the definition of the crime of failing to pay a defined minimum tax, and the definition of the punishment that fits that crime. So...where in the Bible does God tell us what the minimum tax is, who should pay it, and who we should pay it to? And – should a man be deficient in paying that tax – what penalty should be inflicted on him? This last challenge may be the easier, since even our current laws consider failure-to-pay to be a type of theft, and we could go with the Biblical principles of restitution required in other types of theft.

However, from my study, even of Rousas J. Rushdoony’s works, as a recognized proponent of the application of the Mosaic case-laws of the Pentateuch in our current society, I could find no better justification offered than the temple-tax (tent-of-meeting) example in Exodus 30.

11 The Lord also spoke to Moses, saying, 12 “When you take a census of the sons of Israel to count them, then each one of them shall give a ransom for himself to the Lord, when you count them, so that there will be no plague among them when you count them. 13 This is what everyone who is counted shall give: half a shekel according to the shekel of the sanctuary (the shekel is twenty gerahs), half a shekel as a contribution to the Lord. 14 Everyone who is counted, from twenty years old and over, shall give the contribution to the Lord. 15 The rich shall not pay more, and the poor shall not pay less, than the half shekel, when you give the contribution to the Lord to make atonement for yourselves. 16 And you shall take the atonement money from the sons of Israel and give it for the service of the tent of meeting, so that it may be a memorial for the sons of Israel before the Lord, to make atonement for yourselves.”

The question in this passage, is how this half-shekel contribution toward Yahweh, by the mustered militia (presumably to execute God’s justice: foreign or domestic), “for the service of the tent-of-meeting”, being an atonement and a memorial and a ransom to ward off potential “plague” from Yahweh – how is this related to our income taxes that pay for a standing military, domestic policing, and massive wealth-redistribution? The characteristics of the Ex. 30 ‘head tax’:

-

It is not regular, but occasional

-

It is not related to income but a fixed amount per person

-

it only applies to men 20 years old and upward, who agree to come to the muster (there were exemptions: New bride, new real estate, fear Dt. 20)

-

there is no authorization for any humans to apply punitive force against anyone not paying the levy, the only threat was from God Himself

Because of these factors, I do not believe there are sufficient parallels for us to use this passage to justify anything like our current income tax.

If we are going to take our cues from the Bible about how much income tax is required from a person, and what the punishments should be, we seem to be limited to voluntary covenants. If any Biblical punishments could be established, it would have to be double restitution for theft in violation of voluntary contracts, backed by execution as a backup for contumacy against the law and courts of appeal. And the only way to justify a mimimum tax with double-restitution penalties would be to establish some kind of civil-government-ownership of a person and their labor.

So if the only allowed job of a government is to commute God’s wrath against evildoers and failure to pay a minimum tax is never registered as evil anywhere in the Bible, what are we to make of “...taxes to whom taxes are due.” in Romans 13?

4. Development of American Tax Law: The income tax in America is fairly recent. In the beginnings of settlements of the continent, since the Bible was so much more influential, it would stand to reason there were very minimal taxation. At the advent of the Constitutional era, the authority for defining taxation shifted from the Bible over to the majority Will of the People. Especially after the Civil war, and in the days of FDR’s Great Depression and WW II, taxation began to accelerate to pay for universal, compulsory ‘education’, and the flood of new ‘benefits’ included in the New Deal. Instead of belonging to God, the spirit of the age shifted to “This land is your Land, this land is my Land” type of Group Ownership which is the foundation for socialism, fascism, and communism. From each who has wealth to each who doesn’t have wealth. Since everything belongs to all of us, someone has to see to it that the immediate use of The Stuff is fairly distributed. You know the drill, “democracies” always end up being the few pigs are more equal than the many, and tyranny oppressing “in the name of the People”.

But anytime I have drilled down to study the income tax law in America – from Constitution to the Present – the witness has always ended up being “there is no law”. This is one of several approaches:

5. Excise vs. Direct: Direct taxes are not allowed to the Federal Government. There cannot be an income tax direct to every person. Excise taxes have to do with special privileges which are optional. Somehow, in our quasi-constitution system, these distinctions have been officially maintained and upheld in courts of law, but not without a lot of bluffing and deception. When you get down to saying it out loud, in public, that any and every individual is punishable for not paying whatever minimum tax the majority vote or the oligarchs claim he needs to pay – that would be tantamount to saying that individual is the chattel property of the government. And since we remain so proud that we abolished slavery in the 1860’s, we are not about to admit it remains to the current moment in tricky ways.

6. Liable vs. Immune: The Direct/Excise distinction gives rise to the specialized, legal definitions of certain words in remaining tax law codes. Turns out, if you are not engaged in a specialized, privileged relation to governmental agencies or the corporations they “create”, you are not an “employee”, and the money you trade for your work/labor is not “wages” or “income”. Even “trade or business” has the limited meaning that you are in a specialized service contract with one of those governmental entities. Besides being liable for income tax because you are an obvious employee of government, or a contractor for the same, you are liable if you are an officer of one of the corporations they “create”. If you just work for a corporation as a non-officer, you are not an “employee” in the special legal definition of the word. The application of these directives in the law means that we have been paying the income tax voluntarily all this time. We did not have to file the W-4 to grant permission to our employers to withhold money to deposit to our tax account. They do not have to issue a W-2 to report what we traded for our labor in the course of a year. We did not have to volunteer to pay a percentage of that compensation for our services. Our labor did not belong to the government. It was worth what we traded for it, so that it was not increase or profit in that same way that you buy an item for $1 and sell it for $5. And even there, it is your labor or service or effort that accounts for that $4 “gain”.

Will you take my word for this? Certainly not. Like me, you are probably going to have to think on these things a long time as you look at the Bible and look at the world, and avail yourself of reliable, source-document history. I was a slow learner and had to bump into this many times, and think about it a lot more from many angles to see it as I do. I have only given you the briefest of summaries of the tax-law issue, and tried to lay out introductory logical/spiritual propositions that bear on the topic. As far as human legality, I refer you to the best resource I am aware of at the moment, and that is the book, “Cracking the Code: The Fascinating Truth about Taxation in America” by Peter Eric Hendrickson – and the website; https://losthorizons.com/ This material will be so alien to almost everything we have seen and thought and heard and done during our lifetimes, it will take some serious mental concentration and repetition before coming to taking action more in accord with our knowledge, conscience, and courage. I wish you well in your investigations. [After filing in this manner for several years, I have received credible counsel that it has some danger and may not be the ideal way to approach minimizing income tax. I no longer recommend it, although I encourage you to try to understand it.]

7. To Whom Tax is Due: But since it is obvious that God has instituted civil government since the covenant with Noah after the Flood, and those who work as servants of God, to teach and enforce God’s definitions of crime and punishment are “workmen, worthy of their pay”, we know that money and/or effort are going to have to be contributed to these specialized workers. I have tried to prove above that God has disallowed governmental force to punish any who fail to pay any minimum contribution to support civil government. Now I try to prove that God will punish any who do not voluntarily support obedient governmental functions. Human life is comprised of the physical functions of our human heart, brain, and all other systems. It is made up of our choices to think, say, and do one thing instead of the other, and it means being stewards of all kinds of property which we have the right to control instead of someone else. Life, liberty, property. Crime is that subset of possible sins – usually taking away someone else’s property, liberty, or life – which God has authorized Bystanders to punish. For those EvilDoers, God has ordained specified punishments, by other humans, which will consist of some form of confiscating, coercing, or killing. See the pattern?

But in a sinful, fallen, world – what are the consequences if a sufficient portion of the population refuses to punish the way God directs. Maybe they punish the innocent or reward the guilty. Their punishments are too harsh or are too lenient. Within a year of this writing, we have seen in many downtown sections of large cities across America, groups of people criminally murdering, assaulting innocents, stealing, and destroying property. We have seen city and State governments encouraging or ignoring these crimes instead of punishing them as God requires. As you read this, thousands of government programs across this land are taking wealth extracted by taxation and inflation, and spending it in a manner God calls criminal – by murdering, robbing, and coercing people against their will. Is it obedience to God to be supporting these operations – either voluntarily, or under coercion? What did God mean, when He instituted civil government after the Flood, when He warned He would require men to punish crime?

Gen 9:5 I certainly will require your lifeblood; from every animal I will require it. And from every person, from every man as his brother I will require the life of a person.

There are various passages of Scripture which show how God threatened and punished men responsible to punish crime and did not. History, both ancient and modern, show this all the time. You can see it played out as a universal principle. If we do not require thieves to pay double restitution, pretty soon everybody is stealing from everybody else. If society will not execute capital criminals, it won’t belong before the capital criminals will be executing quasi-innocent members of society. We see this every time an unexecuted murderer is released and murders again. Will not God hold responsible for the 2nd murder, those who had the responsibility to properly take the life of the murderer after his first offense? From this I understand that God, Himself, will “spank” any society proportional to their refusal to punish criminals as directed. From this comes the principle that if people refuse to participate in enforcing God’s laws themselves and refuse to voluntarily support those who work hard at studying, applying, and teaching God’s definitions of crime and punishment (think kings, presidents, prime ministers, legislatures, judges, generals, soldiers, policemen, and sheriffs with their deputies), then He will allow men to criminally coerce, rob, and murder otherwise-innocent individuals within that society. He will do it in accordance with grace, truth, justice, and all the aspects of His character. This means that what each of us think, say, and do concerning punishment of crime – matters. When was the last time we made a voluntary contribution towards a man or institution who was promoting God’s directed punishment for the crimes He defines? Is there a better way to motivate God to protect you from being forced to involuntarily pay arbitrary taxes to wicked criminals who are wasting your wealth or using it to steal, kill, and destroy?

8. War: A deeper study of America’s wars from colonization to the present shows that they have not delivered as advertised. How many of them killed more people than they saved? Were there any conflicts who left the populations of the opposing nations more free and prosperous than before the war? Smarter men than I have concluded America has always ended up with less freedom after every war that was supposed to protect our freedom. But there has been some pretty good attempts at formulating a Biblical Just-War Theory which would provide protection for a nation from its Military-Industrial Complex. Has the Church embraced and taught these principles? I concur with those who have observed that all of our wars of recent centuries have been “bankers’ wars”. What war was ever waged by first accumulating adequate amounts of tax revenue and then spending those savings on wages and materials to prosecute a just, defensive war? Have they not all been prosecuted by unBiblical borrowing, deficit-spending, unjust taxes, or fraudulent money?

9. International Law: I have heard recently, that even in the consortium of nations less righteous and less democratic, and less free and prosperous as the United States, they understand that it is treason to pay taxes to a country which is doing what government officers are doing in America. Will God hold us accountable for supporting such a ruling class, when the actual letter of the law does not require us to do so? Apparently it is time for good men and true to terminate their positions in government, unless they can prove they are doing more toward getting God’s law implemented than they are furthering the agenda of lawless criminals. Any man in any branch of the armed services, sworn to obey this president and to defend against all enemies: domestic and foreign – needs to recognize who the Bible defines as enemies and defend the innocent against them, even if those enemies are the officers over them and a man claiming to be president. It is time to recognize that the Bible is international law. There is an Emperor, and empire, and imperial law. It is not the United States and never has been. Instead, this country has been aggravating its rebellion against the Emperor and His imperial law. Now we shall see who is stronger. Now we shall see who is evil and Who is good.

10. So this is the year (2021) I have begun the experiment. I have studied the law and in accordance with that law I intend to file a 2020 tax return which more honestly and accurately corrects the W-2’s to show I had no “income” as the law counts income. I am in the process of filing Amendments to prior years to also correct the reported “income”. We shall see what happens [Federal and State sent all the withholdings back]. Recognize that this is not enough. We also have to ply the resources of our stewardship to support those who are calling for God’s punishments upon those God calls criminals. We need to pay tribute to those to whom it is due. It is not due to criminals. The LostHorizons web pages have lots of stories of how many others have stopped volunteering their wealth by conforming to the law as it is. Nothing I have written here was intended to claim that Cracking the Code, or anyone involved in conforming to the shreds and tatters of our Constitutional heritage is 100% Biblically accurate on their application of God’s laws. I only encourage you to engage courageously with these persistent questions and hard lessons from history and join me in following your conscience in the right direction, as your faith supplies, in the way that Christ, our Judge, would count right, as He has revealed it in the Bible.

Also, https://www.losthorizons.com/BulletinBoard.htm is a great resource for seeing the actual forms others have submitted and seeing how Federal and State taxing agencies have acknowledged there was no income tax liability.

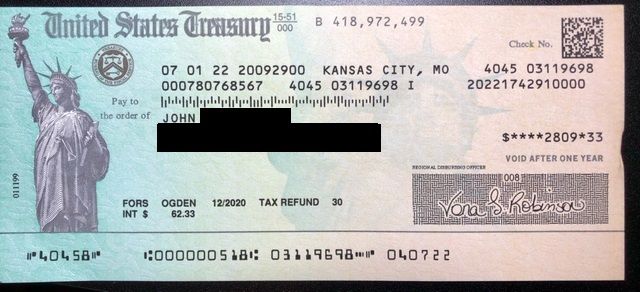

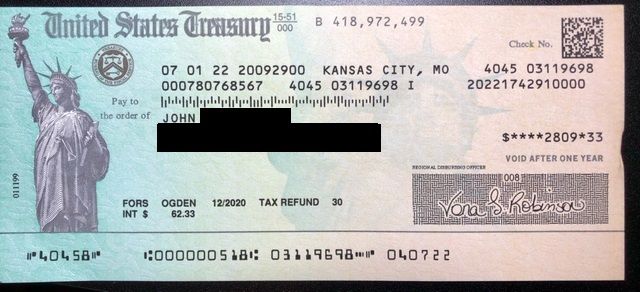

So in 2020 and 2021, both Federal and Oregon sent back all my withholdings as filed. 2021 was surprising in that 6 days from filing my paper return, Oregon had my refund check to me, thanking me for paying my taxes. Both years, the only communication I received from IRS/Department of Treasury was simply the refund check as above.

With that background, let’s take a detailed look at the main Bible passages which modern Christians are using to support an obligation to pay whatever taxes Federal, State, County, and City administrations call for. [“Render unto Caesar”, “Let every soul be subject to the governing authorities....Render therefore to all their due: taxes to whom taxes are due.”]

Mt 22:15 Then the Pharisees went and plotted together how they might trap Him in what He said. 16 And they *sent their disciples to Him, along with the Herodians, saying, “Teacher, we know that You are truthful and teach the way of God in truth, and defer to no one; for You are not partial to any.

This is not unusual for any student of the Old Testament trying to obey the law of God.

Ex 23:2 You shall not follow the masses in doing evil, nor shall you testify in a dispute so as to turn aside after a multitude in order to pervert justice; 3 nor shall you be partial to a poor man in his dispute.

They thought they were so smart they would crush Him between the hammer of the Roman Government and the anvil of the Popular Notions.

17 Tell us then, what do You think? Is it lawful to give a poll-tax to Caesar, or not?”

If he affirmed the lawfulness of using a Roman-issued coin, whether it was for the service of the temple, or (worse) required to be paid to the emperor – that was lead the crowds to repudiate Him, because they generally rankled under having to go through the motions of honoring Caesar above God and their own national sovereignty under God. Obviously, if he agreed with the crowds, He would be subject to censure or seizure by the tax-collecting civil government. Like they used it in the trial before Pilate – Luke 23:2 And they began to accuse Him, saying, “We found this man misleading our nation and forbidding to pay taxes to Caesar, and saying that He Himself is Christ, a King.”

But He rejects their Yes/No answer trap and follows the spirit of all the prophets who brought Covenant Lawsuit against the disobedient nation, by way of reminder that they had been pressured into the idolatry of worshipping and serving the Creature rather than the Creator as part of the outworking of God’s judgement.

18 But Jesus perceived their malice, and said, “Why are you testing Me, you hypocrites? 19 Show Me the coin used for the poll-tax.” And they brought Him a denarius. 20 And He *said to them, “Whose likeness and inscription is this?”

There is reason to believe that this denarius had a likeness of Tiberious Caesar, and the writing on one side: “Caesar Augustus Tiberius, son of the Divine Augustus” and “pontifex maximus” on the other with a depiction of Pax, the Roman goddess peace, seated. The title means “Highest priest” and there are some interesting notes on that here: https://www.livius.org/articles/concept/pontifex-maximus/

This was the guy responsible to maintain “peace with the gods”, which Jesus accomplished by His propitiation on the cross. He was to be interpreter of omens and recorder of the following events that validated the prophecies of the omens. Was not Jesus the the greatest prophet who gave the prophecy/omens whereby His office was validated that He spoke the words of God? And, most obvious, if Tiberius was ‘son of the divine’, that is clear usurpation of Christ’s claim as unique Son of God. Almost in every way, the message of this coin was blasphemous and contrary to the desires and responsibility of the Judean population at that time. We see all through ancient history, we see that heads of civil government were all considered as appointed by the stronger gods in the spiritual realm, who would act to punish those who did not comply with that human leader’s ordained authority. It was very clear in the Torah that the earth and all it contains (including the people on it) belong to Yahweh as the creator. Yet there was tremendous political pressure to the point of execution if you did not verbally swear that Caesar is lord – or owner of all things. There were even public holidays to celebrate aspects of Caesar called “The Lord’s Day”.

21 They *said to Him, “Caesar’s.” Then He *said to them, “Then render to Caesar the things that are Caesar’s; and to God the things that are God’s.” 22 And hearing this, they were amazed, and leaving Him, they went away.

So in the midst of these blasphemous contradictions Jesus only reminds them of what their own Torah was clear about: everything belongs to the true God of Heaven above all earthly creatures. Now if you own something, you have the exclusive right to control it. This is why the authority of Jesus bestowed from the heavenly Father gives Him the right to judge the living and the dead. Nothing could be clearer from the whole Christian Bible that we have an absolute ethical duty to honor Christ’s ownership of all things. This is what Jesus is Lord means. Jesus is Owner. Jesus put this on the table in all manner of ways including prophecy and parable, in a way which men would respond to to the proportion of their spiritual illumination.

So we know that one of things Jesus is saying here is, “Render to the Son of Man what belongs to Him”.

We can also logically deduce that there are men in any given generation of human history – since the Noahic covenant – upon which God has bestowed the power and influence to punish crime, whether they are organized as a top-down empire/dictatorship, or representative republic, or an Athenian, one-man-one-vote democracy. Point being: “Caesar” or human government in general, only has the authorization, duties, and limitations which God has commissioned. So we have to decide what God has given the civil officers so that we might cooperate with their lawful directives and refuse to participate in the unlawful human legalities which are pretended.

When it comes to taxation there are several questions whose answers drive public compliance whether they ever think about these questions or not.

How much tax are we obligated to pay? How much is Too Much? [Government steals from the taxpayer] How much is too little? [some taxpayers pay too little, making other taxpayers pay more than their “fair share”, or government is insufficiently funded to accomplish the things they should]

To whom should be the tax be paid?

What punitive actions should be enforced upon the men who fail to pay the “right” amount of tax?

Who has the authority to define the right amount of tax, and to define what are the associated crimes and their just punishments.

As in all the discussion above, these considerations are simplified by asking Who is Owner? Then the basic consequences of stealing come in to play. If ‘government’ owns you, then it owns your labor and can charge you ‘rent’ on that portion of your own labor you retain for your own benefit. They own it all, but leave you your “allowance” so that you can provide for your own needs and afford enough ‘pleasure’ to keep you relatively happy working on your master’s tax farm.

If the Triune God owns us by creation and redemption, He is well within His rights to appoint overseers to treat us however He desires. We are taught in Scripture by the prophets and the history, that sometimes he sets up human governors who encourage respect and obedience to God, and sometimes the governors with the civil power are very abusive to life, liberty, and property. Not always, but almost always, if we inquire sufficiently into available information on a culture, a generation, a society – we find that God’s revelation of how He intends to bless or curse the freedom and propsperity of societies – in the Torah – is the predictable pattern again and again. A People tend to get the kind of government they deserve, in the light of God’s revealed Standards. In their perversion, they desire the very things that end up enslaving, robbing, and killing them. Oppressive taxation is one of those curses.

God promised as much through Samuel to Israel. The men in charge in his day had rejected the government of Yahweh and His law standards. No doubt they thought they could come up with wiser laws that would be better for all concerned. God and Samuel warned that the consequences of expecting more strength and goodness from a human than from God Himself would backfire. They were warned that they would soon cry out at the excessive taxation, if not regulation – but that God would not respond and fix it all better as soon as they wanted after they started complaining about what they had done to themselves. I Samuel 8 & 12 contain these obvious lessons.

7 The Lord said to Samuel, “Listen to the voice of the people in regard to all that they say to you, for they have not rejected you, but they have rejected Me from being king over them.

11 He said, “This will be the procedure of the king who will reign over you: he will take your sons and place them for himself in his chariots and among his horsemen and they will run before his chariots. 12 He will appoint for himself commanders of thousands and of fifties, and some to do his plowing and to reap his harvest and to make his weapons of war and equipment for his chariots. 13 He will also take your daughters for perfumers and cooks and bakers. 14 He will take the best of your fields and your vineyards and your olive groves and give them to his servants. 15 He will take a tenth of your seed and of your vineyards and give to his officers and to his servants. 16 He will also take your male servants and your female servants and your best young men and your donkeys and use them for his work. 17 He will take a tenth of your flocks, and you yourselves will become his servants. 18 Then you will cry out in that day because of your king whom you have chosen for yourselves, but the Lord will not answer you in that day.”

Take, take, take! But if the king had a ‘right’ to take, it was because property had been deeded over to the king. If men refused to relinquish said property being asked for, they would be stealing, and the Double-Restitution penalties would kick in.

These Old Rules were in the context of a schedule of things productive operators were oblilgated to contribute towards God and His work. There was the basic tithe (tenth of Increase) owed towards the Levites, which they in turn tithed to the priesthood. Both classes were involved in serving God in His ‘house’ (tabernacle/temple), but also served as scholars, teachers, judges, and civil officers. Some of these functions are related to what we moderns see our tax money go toward. Some see yet another 10% directed to be spent on holiday social gatherings, either the Sabbath assemblies, or the 3 major feast ‘weeks’ each year where all who were able would come to a central location for social and worship activities, which included a lot of feasting on special food and drink. Some count up to 80 days a year where work was to be set aside for special activities. Then if you count the idea of the ‘poor tithe’, which was supposed to be 10% every third year (however they spread this out), and designated for the local Levites and poor people, this all could amount to an annual 23 1/3rd percent of productive increase.

This was not counting other offerings like the First Fruits of the harvests, the firstborn of animals, the first harvests of new orchards, holiday offerings, freewill offerings, and sin offerings. Some of these last ended up as distributed feast material for the communities assembled on their feast days. Then you add the required work cessation required on the weekly Sabbaths and other holidays, plus the every 7th- and 50th- year rest from agricultural production and it all seems like a whole lot.

But God promised that if everybody would follow this schedule and these various, voluntary contributions of time, produce, and expensive livestock – that He would still provide them sufficient abundance to handle this load and have much left over for their own pleasure, and surplus to help the poor. Not that a lot of this taking time off work, and contributing to the communal feasts isn’t something that humans end up doing anyway. The test was, will they do it under God’s wise and loving direction, or think they had a much better way of producing freedom and prosperity.

Oh, and there is one other tribute/contribution mentioned in Exocus 30. Rushdoony’s idea of the poll- or head-tax mentioned there which was to be contributed at a muster or census, and given toward the “service of the tent of meeting” – he thinks is what we should model our taxation system after. Others point out that in this, as well as in the tithe, sabbath, and sacrifices – no human agency was authorized to punish any other human for NOT contributing or paying the specified amounts. Thus it does not really fit into our definition of taxation, where there are civil penalties for failure to pay. Also, it is not tied to property value, labor value, nor is it a use-tax per se. It does actually go towards some related aspects of government. It is related to Tent-Of-Meeting which is the Emperor’s throne-room, where worship activity serves the judge, lawgiver, and law-enforcer, and where administrators assist with His jurisprudence by providing appeals courts (levite judges, high priest). Still not flexible enough to fit what we think of as taxes.

So as God owned the land, and the people on it, and was ultimately in control of Production – He both had the right to define the right amount of voluntary contributions which should be given to the right functions under His law, and He had the power to bless with abundance over and above these designated contributions and living expenses. Subsequent history shows how prosperous His covenanted people were when there was substantial obedience and how famine and slavery and tyranny resulted from their rejection of His laws.

We see the same dynamics in our own generation. Some events are so irrational and counterproductive that it is easy to say God is personally overriding normal economic growth or cultural health and punishing us for things we are doing wrong. But there is also the aspect, as you study things deeper, that it is the victims themselves who are shooting themselves in the foot by preferring to do foolish and harmful things that directly cause the unintended and hurtful consequences. Graduated income tax is only one of many obvious examples of this. Tax the productive more severely so that the UnProductive receive more benefits. This will discourage the Productive from being productive and tempt them to produce less or abandon their ranks altogether and join the UnProductive. It also encourages the UnProductive to desire more ‘free’ handouts.

Granted, if more men desired the function of punishing crime to be reduced to the basics of God’s revealed law like enforcing contracts, double-restitution for thefts, death for capital crimes – the tax-load would shrink dramatically. Yet if we are consistent with our premise – that government enforcement actions be limited to what God’s law requires – it eliminates taxes altogether. How, because nowhere in God’s law is it authorized to define a taxable amount or define any kind of punishment for failure to pay such a defined tax. What about rent on Government-owned land, structures, or people? Nowhere in God’s law is human civil government granted ownership of land or people. You might argue that the Levites and the priests were designated income and real estate for the purposes of facilitating worship and public justice (hierarchy of courts, cities of refuge) but this was voluntary and not coerced. Failure to properly support these functions was definitely a transgression of God’s law, but not criminal in nature. Bystanders were not required to punish those who failed to voluntarily contribute a sufficient amount. God did not relinquish His role to punish sin in this area directly. He did not delegate that responsibility to men.

From this I deduce the principles taught in Romans 13 do obligate us to sufficiently and voluntarily contribute to the training and enforcement of God’s civil laws. No man is responsible to punish us when we sin in this area by a failure to conform to- or transgress the law of God. Nevertheless, God enforces the law by afflicting the entire society by injustice to the degree that we fail to embrace His standards. If we will not contribute what is due, to participate in executing murderers, He will allow murderers to rise to civil governmental influence to the degree that relatively-innocent people end up getting killed. If we refuse to demand of thieves that they pay their victims double restitution, He allows thieves to attain official status and by taxation and inflation – the relatively-innocent begin losing their property ‘rights’. We will either materially participate in the enforcement of God’s laws through God’s servant-administrators, using the sword not in vain to punish evildoers, but encouraging those who do right – or God will allow bad men to rise to power who will force us to support their criminal agenda.

So God does provide these two alternatives for us to choose from. He did not create, in His universe, the third possibility that the Majority can vote for laws better than His which result in more prosperity and freedom than His blessings upon those who honor His laws.